App Overview

FiscalPOP México simplifies tax invoicing for Shopify stores in Mexico by generating CFDI 4.0-compliant invoices effortlessly. Customers can self-generate invoices post-checkout or through a dedicated store page, while merchants can create global invoices monthly—either automatically or manually. The app also supports partial/full reimbursement credit notes and payment CFDIs, ensuring comprehensive tax compliance. With intuitive configuration and minimal setup (only requiring your SAT CSD certificate), FiscalPOP streamlines operations for seamless tax management.

Screenshots

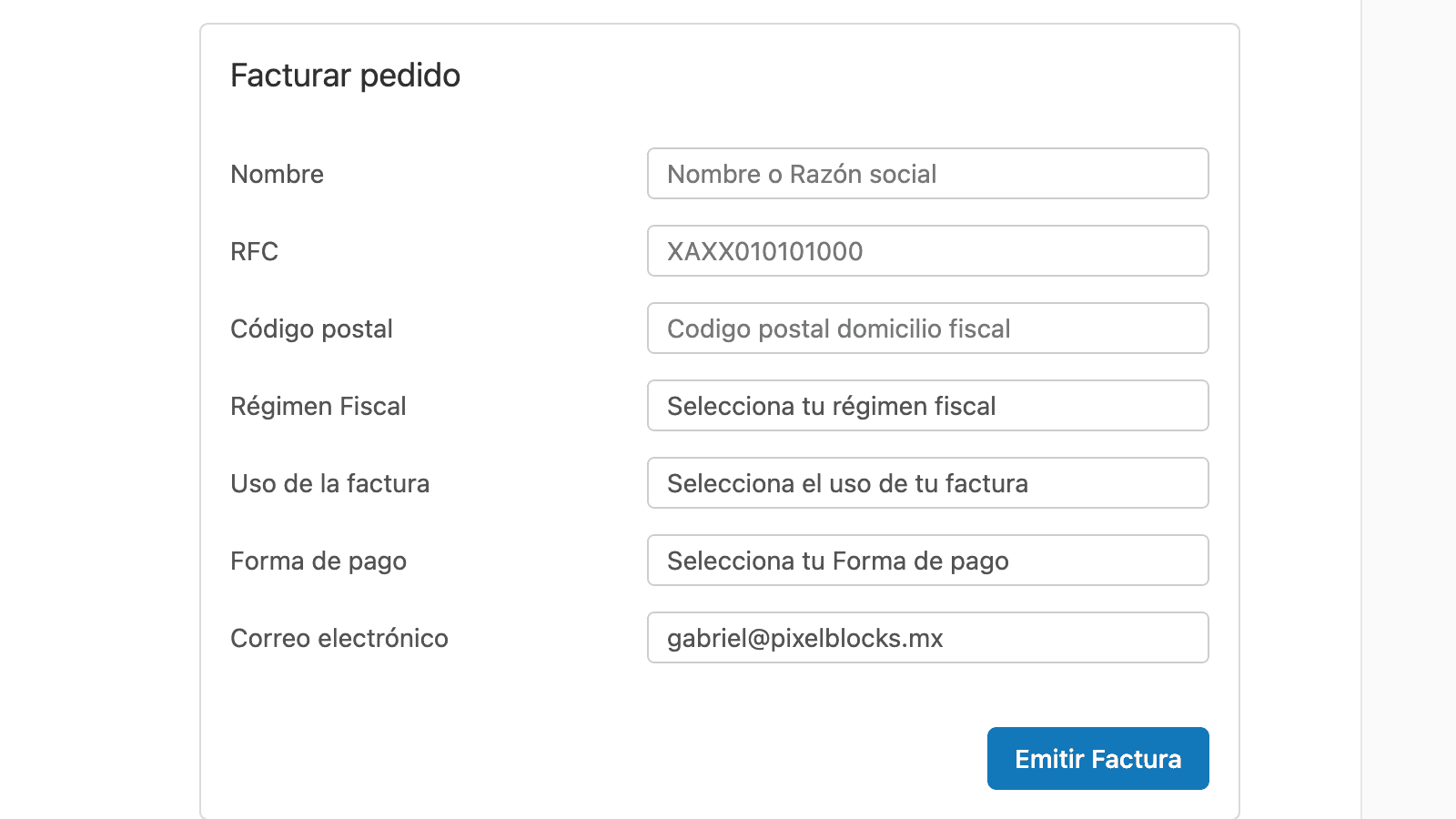

CFDI invoicing from your Admin and CFDI Self-invoicing for your customers on your online store.

FiscalPOP allows you to generate CFDI 4.0 compliant invoices for all your sales. Your customers will be able to self-generate their invoices after Checkout, and you will be able to generate global invoices either automatically or manually. Our product configuration and seller tax information configuration are very simple to use, the only requirement you need to start using our app is your SAT CSD certificate.

Key Features

- Tax invoicing for your customers on the Checkout Thank you page

- You may add a page to allow customers to self-bill anywhere in your store

- Global tax invoices at end of month, automatically or manually

- Partical or total reimbursement credit notes

- Payment CFDIs and PPD type tax invoices

FiscalPOP México FAQs

No. FiscalPOP México pricing starts at $4. For more details about FiscalPOP México pricing, check here.

Get in Touch

with us

Whether you need more information on how LetsMetrix can help enhance your Shopify experience, or require technical support, don't hesitate to contact us. We're available 24/7 via email, phone, or live chat to ensure you have all the assistance you need.