App Overview

Taxdoo streamlines VAT compliance and financial accounting for Shopify e-commerce businesses. By connecting to marketplaces, stores, payment systems, and ERPs, it collects transaction data, applies the correct EU and UK VAT rates, identifies obligations, handles registrations and returns, and offers seamless exports via CSV or DATEV service.

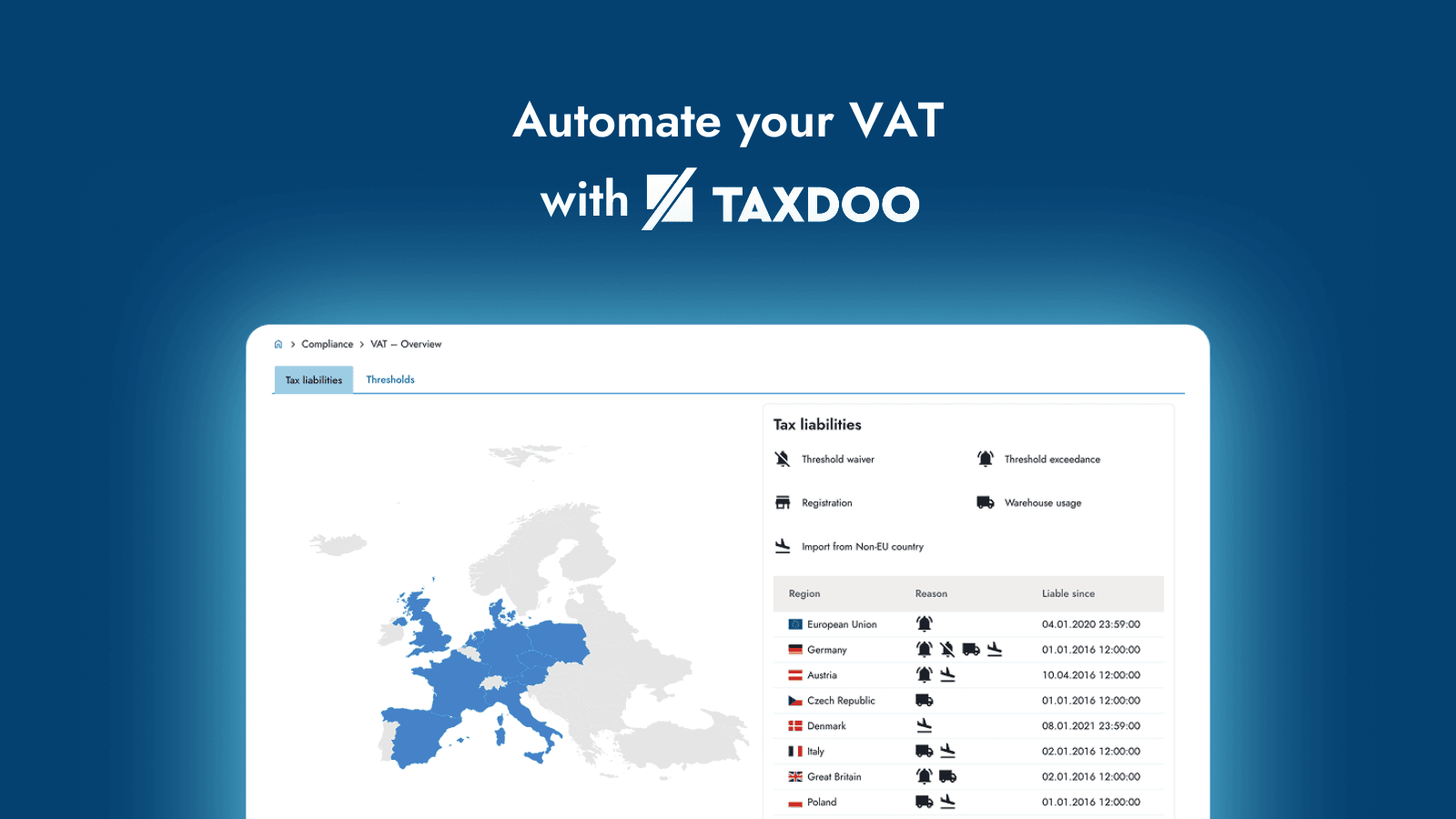

Screenshots

Scale your business across the EU with automated VAT compliance & efficient financial accounting

Taxdoo is a software for automated VAT compliance and financial accounting in e-commerce. It records transaction data via connectors to marketplaces, stores, payment and ERP systems, applies correct EU and UK VAT rates, recognizes your VAT obligations and handles VAT registrations and returns for you abroad. You seamlessly transfer prepared data to your financial accounting system via CSV or DATEV service in compliance with GoBD.

Key Features

- Automated collection & VAT assessment of your transaction data

- Recognize VAT obligations at a glance in your Taxdoo dashboard

- VAT registrations and returns in the EU & UK (optional)

- Exports for One-Stop-Shop, pro-forma invoices, Intrastat and much more

- DATEV-compatible, GoBD-compliant exports & Buchungsdatenservice (optional)

Taxdoo ‑ VAT & Accounting tool FAQs

Yes! Try Taxdoo ‑ VAT & Accounting tool free plan. For more details about Taxdoo ‑ VAT & Accounting tool pricing, check here.

Get in Touch

with us

Whether you need more information on how LetsMetrix can help enhance your Shopify experience, or require technical support, don't hesitate to contact us. We're available 24/7 via email, phone, or live chat to ensure you have all the assistance you need.