App Overview

For e-commerce businesses navigating tax obligations across multiple regions, LOVAT Compliance simplifies regulatory reporting with ease. Leveraging advanced technology, it automates compliance tasks, from determining correct taxes to submitting reports online. Supporting 111 countries, LOVAT streamlines VAT, Sales Tax, and EPR management. Its user-friendly approach ensures businesses stay compliant effortlessly.

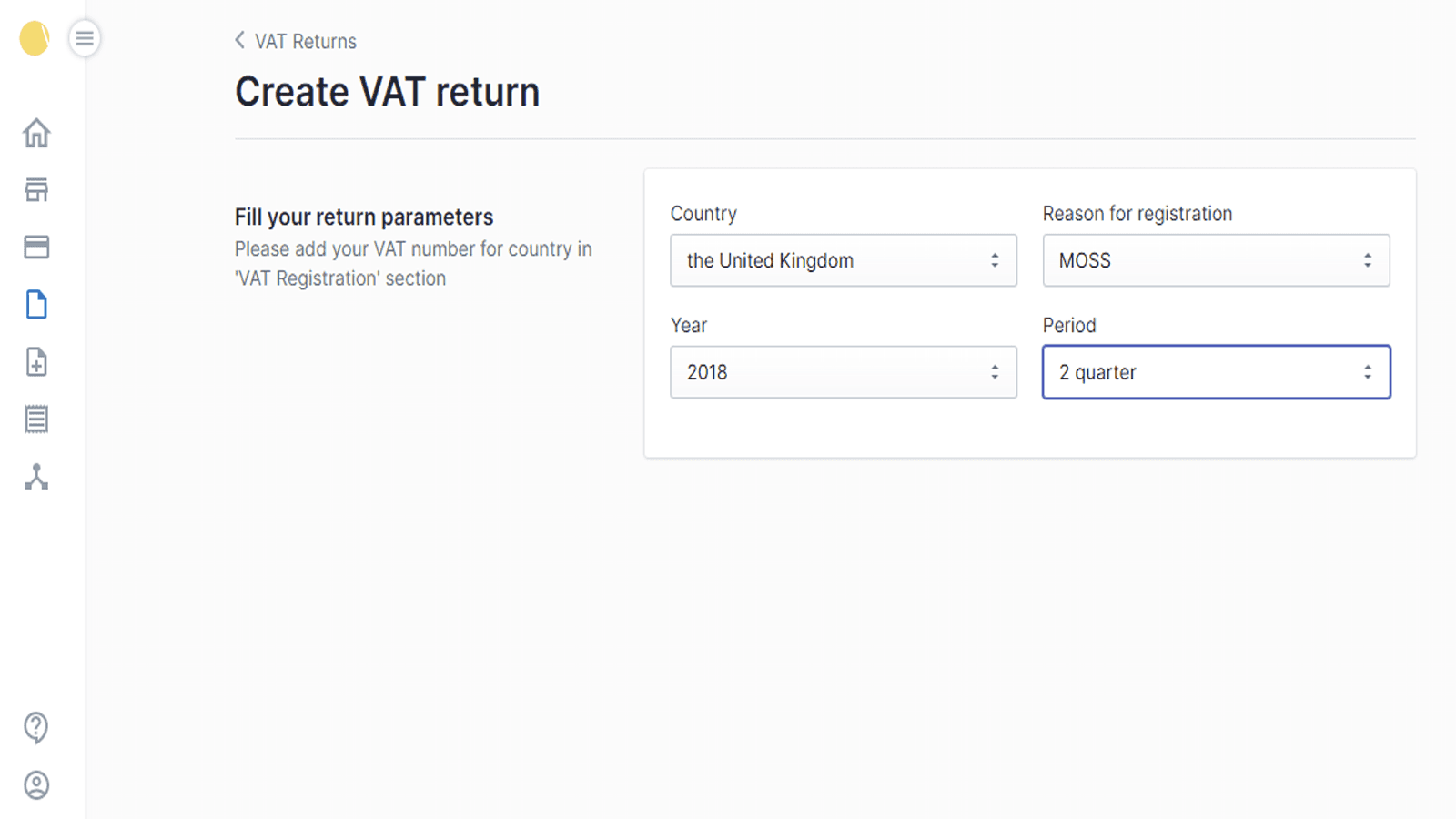

Screenshots

LOVAT is software for global VAT/Sales Tax liabilities. Easy reporting to relevant tax authorities.

For business owners keeping up with all the taxes and the latest regulations can be exhausting and time-consuming. LOVAT is an online tax compliance software for e-commerce and uses deep tech technology to enable regulatory change tracking, systematized regulatory reporting, and associated auditable record-keeping. With software’s ease of use any person can manage their company VAT and sales tax reporting liabilities as everything is intuitive and can be solved online within minutes.

Key Features

- Upload your Shopify sales data and check your tax obligations.

- Correct tax determination for any location.

- Online calculation, preparation and submission of VAT/Sales Tax/EPR reports.

- Work with tax authorities of 111 countries.

- Assistance with VAT/Sales Tax/EPR registrations, payments, tax audit.

LOVAT Compliance FAQs

Get in Touch

with us

Whether you need more information on how LetsMetrix can help enhance your Shopify experience, or require technical support, don't hesitate to contact us. We're available 24/7 via email, phone, or live chat to ensure you have all the assistance you need.